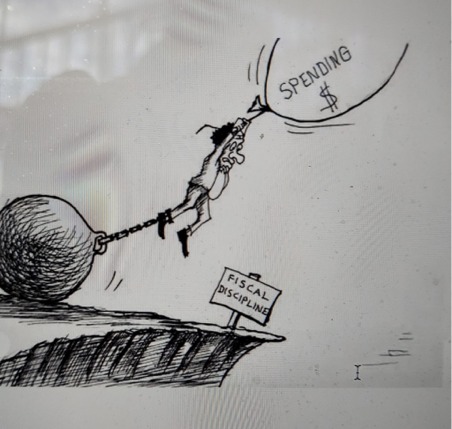

Since the end of the civil conflict in 2002, Sierra Leone has been preparing and implementing its national development plan that lays out the country’s strategic priorities and key objectives over five years. This exercise is almost always done independently of the annual budget process and the consequence has been the preparation of a wish list of programmes and activities which cannot be realistically achieved given the fiscal space of the Government. The failure to link policy, planning and budgeting is the most important cause of poor budget outcomes in developing countries. To be an effective instrument of financial management, the government budget must be credible.

In recent years, the implementation of a credible budget has been challenging due to the consistent discrepancies between approved and actual expenditures. The plan to reduce the variance between the approved budget and actual will always be challenging if expenditure cannot be better managed during budget execution. When actual budget outcomes significantly vary from the original budget, it brings considerable challenges to budget execution, often with negative consequences for some Ministries, Departments and Agencies (MDAs) and their activities.

Since 2001, the Government of Sierra Leone has adopted the Medium Term Expenditure Framework as an effective and efficient system of budgeting that ensures optimum allocation of resources. A Medium Term Expenditure Framework (MTEF) is a budgeting tool developed for achieving the best social and economic outcomes from available government resources. While the term MTEF implies a focus on expenditure, the process emphasises improving the planning of all types of revenues and financing decisions. It links the Government’s development strategy, medium-term three-year rolling budget, and the annual State budget.

Although progress has been made in defining spending objectives and attaching costs to activities, a comprehensive MTEF has remained elusive. The budget preparation process has become a box-ticking exercise. This is because, for most years, MDAs and Local Councils only get a fraction of their approved budget. Consequently, MDAs will only make minor adjustments to the previous year’s budget, taking on board the guidelines in the Budget Call Circular. Recent Public Expenditure and Financial Accountable (PEFA) reports have highlighted the poor performance of budgetary outturns.

The Public Financial Management (PFM) Act 2016 provides the institutional arrangements for implementing the MTEF effectively. Section 22 of the PFM Act 2022 requires the Minister of Finance to prepare macroeconomic and fiscal forecasts, which should contain the fiscal policy objectives and a set of integrated medium-term macroeconomic and fiscal targets and projections. Furthermore, Section 56 of the PDM Act 2016 also mandates the Minister of Finance to request Heads of MDAs to submit for approval monthly forecasts under the approved budget in the Appropriation Act monthly forecasts for the period of time as specified by the Minister.

Recent fiscal policy pronouncements from the Ministry of Finance have emphasised the need to strengthen public expenditure management to create the fiscal space needed for spending on priority areas. The Medium Term National Development Plan (2019-2023) ends this year and the next strategy (2024-2029) should be anchored on the President’s five key pillars. Accordingly, the medium-term budget for 2024-2026 should be based on the objectives in these five pillars. Over the years, despite the issuance of budget ceilings, MDAs have tended to prepare budget estimates in excess of their ceilings. On the other hand, budget predictability has been poor as allocations are not released on time. This undermines planning and makes it challenging for MDAs to execute their activities.

To counter these challenges:

• The Macro Fiscal Working Group should provide a realistic medium-term forecast of the resource envelope, considering domestic and external factors. The resource envelopment must be used to set credible ceilings for MDAs.

• The Ministry of Finance should endeavour to introduce some level of predictability in releasing allocations, which should be guided by the monthly forecasts from MDAs. Improving predictability in the release of allocations will enhance budget credibility and instil confidence in the execution of the budget.

• MDAs and Local Councils should be trained to prepare properly costed and feasible medium-term sectoral expenditures linked to the national strategy.

• MDAs and Local Councils should have quarterly budget execution reports that will detail progress made in implementing activities in the approved budget and for which allocations have been disbursed.

• MDAs and Local Councils should submit a comprehensive half-yearly report to the Ministry of Finance, the Ministry of Local Government and Parliament before the budget policy hearings are held. This report should highlight the success and challenges in the execution of the approved. It will also give Parliament an opportunity to assess how the approved budget is being implemented. Furthermore, time should be created for performance discussions to understand the challenges in executing the budget.

• Allocate resources to the National Monitoring and Evaluation Directorate to conduct monitoring exercises on activities implemented by MDAs and Local Councils during the year. The monitoring reports should be discussed at the Cabinet level to track progress but also address challenges in the execution of the budget.

• The Ministry of Finance should explore the possibility of an inter-ministerial budget for activities that cut across various ministries.

Franklin Sisabu Bendu is an Economist.